Last Friday, I was invited to attend a wonderful event organised by Bajaj Allianz Life Insurance at The St Regis, Mumbai. The event marked the unveiling of Bajaj Allianz Life Insurance’s online term plan – e-Touch, a complete protection plan built to safe guard us and our loved ones from various uncertainties in life.

Like I said before, no matter how much we plan, we can never quite predict the future. Are we truly prepared to face the ‘what if’ scenarios in our lives? For example (God forbid), if you meet with an unexpected accident tomorrow or if one of your loved ones falls critically ill – Are we equipped with the security and safety in uncertain times?

In case you aren’t, wait no longer!

This coming new year, gift your family a comprehensive protection solution against the #IfsOfLife – Bajaj Allianz Life eTouch Online Term, a regular premium payment, pure term and health cover plan.

Features & Benefits:

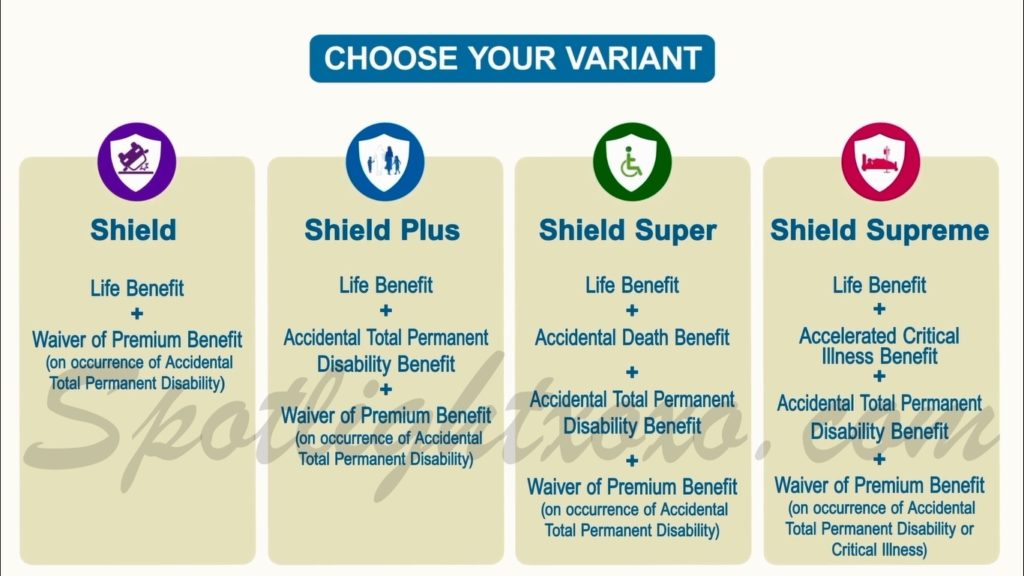

To put it simply, the plan provides life cover combined with benefit on accidental death, accidental total permanent disability and 34 critical illnesses till the age of 75. The age eligibility criteria to acquire this plan ranges from 18 to 65 years. The eTouch Online Term has four variants: Shield, Shield Plus, Shield Super and Shield Supreme. The features of each are summed up below:

The plan also offers a premium discount for all policies based on smoker categorization, variant, sum assured slab for each age & policy term. The High Sum Assured Rebate (HSAR) will be applied for every additional ₹ 1lac increase in sum assured above the base sum assured.

Your nominee will also have the option to take the Life Benefit only or the ADB (Accidental Death Benefit) only or both the benefits (Life Benefit and ADB) in any of these 3 ways:

-100% of the benefit in a lump-sum

-50% of the benefit in a lump-sum and the remaining in Level or Increasing monthly instalments

-100% of the benefit in Level or Increasing monthly instalments

You can read more on their website and for more queries, follow them @BajajAllianzLIC They are pretty quick in replying back!

Key USPs of the plan and what sets it apart from other plans:

- It provides a comprehensive protection for you

- It gives you the flexibility to choose from four variant options to enhance your protection

- It gives options for the nominee to receive the policy benefits in a lump-sum amount or in monthly instalments

- It has lower premiums for leading healthy lifestyle for non-tobacco users

My Thoughts

I feel that in today’s uncertain times, the product will play a significant role in an individual’s life. These days, it is absolutely necessary to seek a worry-free protection solution which not only gives you a plain vanilla life cover but also protects you against the 3 Ds – death, disability and disease. This plan is available at a competitive price point which makes it attractive as well. What more? Being an online term plan, it is time-saving, convenient, transparent and easy to use. I highly recommend you check it out.

On the same day, the company also launched ‘B-Fit’, a wellness platform mobile application to help users to set and track their fitness goals. With the aim to help each one of us adopt a healthy lifestyle, the app works like a monitor diary to keep track of all the calorie intakes. It also serves as a food guide which tracks your food habits and gives you options from a wide range of Indian meals with the nutrition value attached. It is also a step tracker, stores your entire health profile and contains curated health content to help you lead a healthy life. But the most exciting part? Each time you complete a goal or target, you’ll be rewarded with shopping credits in terms of vantage circle points. That’s great motivation, no? You can download the app here.

All in all, the event was an eye-opener and great fun as well. It’s always lovely to bump into my fellow blogger friends and receive exciting Christmas gifts. Thanks for the lovely afternoon, Bajaj Allianz – Jiyo Befikar!

Xoxo

Ritwika